Table of Contents

- What is an EIN?

- Do You Need an Employee Identification Number (EIN)?

- What is the Difference Between TIN and EIN?

- Why Do We Need the Nonprofit Organization’s Tax Identification Number (TIN) or Employer ID Number (EIN)?

- Can’t Find Your EIN? Business Tax ID Number Lookup

- How do you Obtain an Employer Identification Number (EIN)?

- You’re Eligible and Ready to Apply for an EIN:

- IRS Requirements for a Legally Formed Nonprofit Organization

- What is 501(c)(3)?

- Is my Nonprofit Organization Eligible for a Tax-Exempt, 501(c)(3) Status?

- Other Types of Exempt Organizations

- How Do You Apply for 501(c)(3) Status for Your Nonprofit Organization?

- Does a Nonprofit Organization Need to Have the 501(c)(3) Status to Raise Funds?

- Obtain Tax Exemption Status From Your State

- Tax-Exempt Organization Search

What is an EIN?

An Employer Identification Number (EIN) is a type of business Tax ID Number (TIN). An EIN is like a Social Security number (SSN) for a business. The EIN is issued on a federal level, by the Internal Revenue Service (IRS), to business entities that are operating in the U.S. and fall into specific categories (e.g., has employees, is a corporation, etc.).

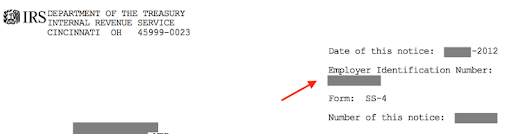

Upon completion of the SS-4 form, the IRS assigns you a 9-digit Employer Identification Number (EIN), which is your account number with the IRS. EIN format: (##-#######)

An EIN also known as:

- Tax Identification Number (TIN)

- Federal Employer Identification Number (FEIN)

- Federal Tax Identification Number (FTIN).

Do You Need an Employee Identification Number (EIN)?

Do You Need an Employee Identification Number (EIN)?

You will need an EIN if you answer “Yes” to any of the following questions:

Do you have employees?

YES NO

Do you operate your business as a corporation or a partnership?

YES NO

Do you file any of these tax returns: Employment; Excise; or Alcohol, Tobacco and Firearms?

YES NO

Do you withhold taxes on income, other than wages, paid to a non-resident alien?

YES NO

Do you have a Keogh plan?

YES NO

Are you involved with any of the following types of organizations?

- Trusts, except certain grantor-owned revocable trusts, IRAs, Exempt Organization Business Income Tax Returns

- Estates

- Real estate mortgage investment conduits

- Non-profit organizations

- Farmers’ cooperatives

- Plan administrators

YES NO

REFERENCE

https://www.irs.gov/businesses/small-businesses-self-employed/do-you-need-an-ein

What is the Difference Between TIN and EIN?

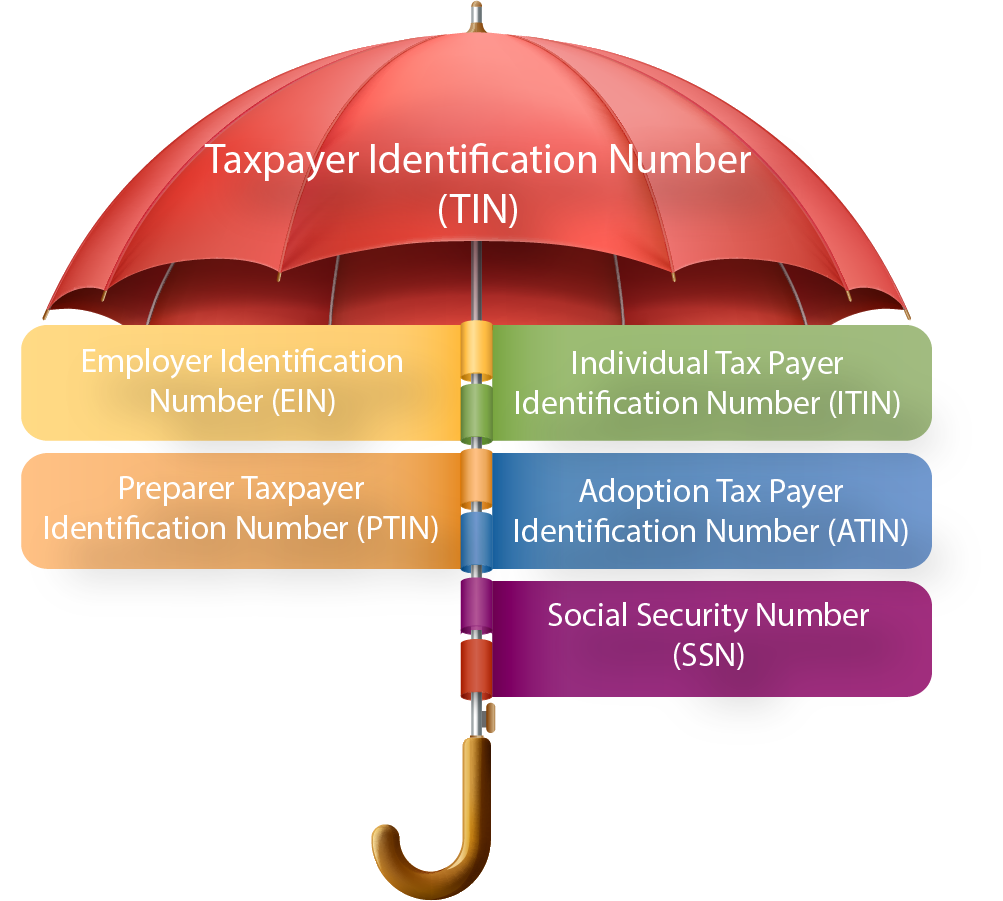

TIN is a Tax Identification Number and EIN is an Employer Identification Number, which are both a unique 9-digit number assigned by the US government (Internal Revenue Service) for tax purposes. However, they are not always the same.

The difference between the two is that an EIN is used for identifying individuals or companies and is a type of a Tax ID Number (TIN). Think of TIN as the “parent” or the “umbrella term”.

There Are Five Types of Tax Identification Numbers (TINs):

- Employer ID Number (EIN): is a company TIN, it’s information about your company. Also used by individuals for their business, instead of a social security number (SSN), to avoid identity theft.

- Social Security Number (SSN): is a personal TIN, it’s information about you. The (SSN) is issued for tax purposes, by the Social Security Administration (SSA) to US citizens that are earning income.

- Individual Taxpayer Number (ITN): is a personal TIN for reporting purposes, it’s only for non-US Citizens.

- Adoption Taxpayer Identification Number (ATIN): is a personal temporary ID number for a child involved in an adoption.

Why Do We Need the Nonprofit Organization’s Tax Identification Number (TIN) or Employer ID Number (EIN)?

Every nonprofit organization must have a Tax Identification Number (TIN) or an Employer Identification Number (EIN). It’s your company’s IRS account number which is used to verify the business for tax purposes.

A TIN/EIN number is required for setting up your merchant account, as well as filing taxes, paying employees, obtaining a business license, opening a business bank account or credit account. You will also require an EIN before filing for state and/or 501(c) tax-exempt status.

Can’t Find Your EIN? Business Tax ID Number Lookup

Upon completion of the SS-4 form, the IRS assigned you an Employer Identification Number (EIN) for your business. A few suggestions on how to find your EIN:

- Check your IRS confirmation letter* for your assigned EIN. (Email, online, or mail)

- *Important document that should be filed and saved.

- Look for your 9-digit number in this format: (##-#######)

- Search IRS or business documents (tax returns, tax notices, business credit report, loans, etc.)

- Call and request your EIN from the IRS.

REFERENCE

EIN Lookup: How to Find Your Business Tax ID Number – NerdWallet

How do you Obtain an Employer Identification Number (EIN)?

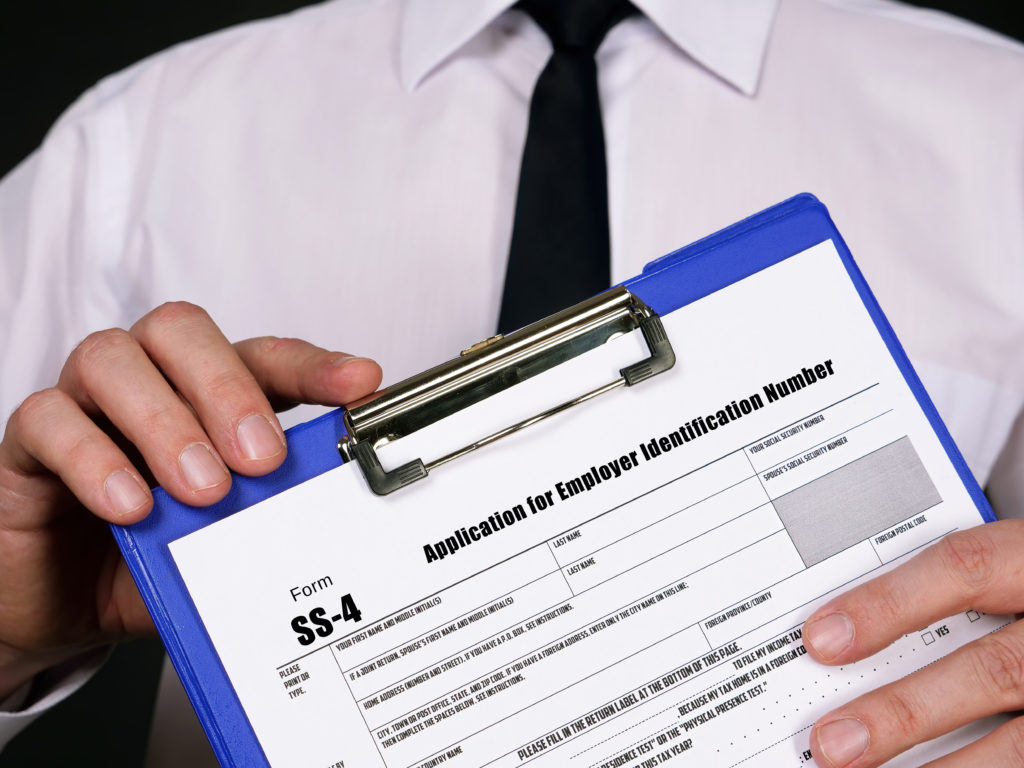

Form SS-4 Application for Employer Identification Number

An Employer Identification Number (EIN) is issued and used by the IRS to identify your company for federal tax purposes. Make sure you’re eligible before applying for an EIN with the IRS! Check your eligibility by verifying if you meet the following requirements:

- You have (TIN) Taxpayer Identification Number (SSN/ITIN) to apply for an (EIN) Employer Identification Number.

- Your principal business is located in the U.S. or U.S. Territories.

- Your nonprofit is a legally formed organization.

- You’re prepared to complete the application in one session with all your personal and business information ready.

- You’re an owner or a duly authorized representative/responsible member of the organization.

You’re Eligible and Ready to Apply for an EIN:

1. Apply for an Employee Identification Number (EIN): How to Apply for an EIN | Internal Revenue Service (irs.gov)

- Apply Online | IRS.gov or

- Download the updated form from www.irs.gov Form SS-4

- Apply by Mail or Fax

2. Save your Employee Identification Number and all your IRS documents (i.e. application)

REFERENCE

Apply for an Employer Identification Number (EIN) Online | Internal Revenue Service (irs.gov)

IRS Requirements for a Legally Formed Nonprofit Organization

Legally forming a nonprofit organization varies from state to state. However, if you plan to apply for 501(c)(3) status, it’s important to take the proper steps and verify the IRS requirements to make sure you can qualify beforehand.

Legally forming a nonprofit organization varies from state to state. However, if you plan to apply for 501(c)(3) status, it’s important to take the proper steps and verify the IRS requirements to make sure you can qualify beforehand.

The following steps must be completed before submitting your IRS application 1023 form. Keep in mind that the order and requirements vary from state to state. Check with your state tax department, starting with the website of your Secretary of State, for nonprofit organization requirements and resources.

1. Register your nonprofit organization name in your state.

2. Form your Board of Directors (volunteers not paid employees). The number of board of directors required varies on your state requirements.

-

- President

- Treasurer

- Secretary

- Vice President

3. Create your nonprofit organization’s bylaws.

-

- Internal affairs operating manual & guidelines

- Elected board members & officers

- Memberships and meetings

- Books and records

- Indemnification clause

- Conflict of Interest clause

4. Incorporate your nonprofit organization.

- Prepare or obtain Articles of Incorporation from your state, which should include:

-

- The dissolution clause

- Necessary IRS verbiage about your purpose that qualifies you for 501(c)(3) status

5. Hold your first official meeting on record. (Meeting Minutes)

-

- Approve/adopt your bylaws

- Elect/appoint your officers

- Designate your principal office

- Set accounting period and tax year

- Plan to open your bank account and file your 501(c)(3) application

- Official report for submitting to state

6. Obtain any necessary business licenses and/or permits.

7. Create your corporate record’s binder.

-

- Articles of incorporation

- Bylaws

- Meeting minutes

- Business licenses & permits

- Annual or bi-annual state reports

REFERENCE

How to Start a Nonprofit – Become a 501.c.3 | Nonprofit Ally

How to Start a Nonprofit 501c3, The Ultimate Starting Guide (form1023.org)

What is 501(c)(3)?

501(c)(3) is a tax-exempt status for nonprofit organizations, which means the organization exists for charitable purpose and is officially recognized by the Internal Revenue Service (IRS) as exempt from paying federal income tax and is eligible to receive tax-deductible charitable contributions from donors.

501(c)(3) is a tax-exempt status for nonprofit organizations, which means the organization exists for charitable purpose and is officially recognized by the Internal Revenue Service (IRS) as exempt from paying federal income tax and is eligible to receive tax-deductible charitable contributions from donors.

Exempt organization types: Exempt Organization Types | Internal Revenue Service (irs.gov)

Is my Nonprofit Organization Eligible for a Tax-Exempt, 501(c)(3) Status?

Churches are automatically considered tax exempt and aren’t required to apply and obtain recognition of exempt status from the IRS. Donors are allowed to claim a charitable deduction for donations to a church that meets the section 501(c)(3) requirements even though the church has neither sought nor received IRS recognition that it is tax exempt.

Churches are automatically considered tax exempt and aren’t required to apply and obtain recognition of exempt status from the IRS. Donors are allowed to claim a charitable deduction for donations to a church that meets the section 501(c)(3) requirements even though the church has neither sought nor received IRS recognition that it is tax exempt.

An organization that is not a private foundation is not required to file an application unless its annual gross receipts are normally more than $5,000. An organization must file an application within 90 days of the end of the tax year in which it exceeds this threshold. (Publication 4220 (Rev. 3-2018) (irs.gov)

For most nonprofit business entities to receive recognition of tax exemption, they must apply for 501(c)(3) status, to the Internal Revenue Service (IRS), by filing the “Application for Recognition of Tax Exemption” with Form 1023 or Form 1023-EZ (simplified version for a small organization), proving to the IRS your nonprofit exists for one or more exclusively charitable purposes:

- Religious

- Educational

- Charitable

- Scientific

- Literary

- Testing for Public Safety

- to Foster National or International Amateur Sports Competition

- Prevention of Cruelty to Children or Animals Organizations

| Designation | Exemption Description |

|---|---|

| 501(d) | Religious and Apostolic Associations |

| 501(e) | Cooperative hospital service organization |

| 501(f) | Cooperative service organization of operating educational organizations |

| 501(k) | Certain organizations providing childcare |

| 501(n) | Charitable risk pool |

| 501(q) | Credit counseling organizations |

| 501(r) | Hospital organizations |

*See Annual Return Filing Exceptions for a complete list of organizations that are not required to file.

Examples of Qualifying Organizations Include:

- Nonprofit old-age homes

- Parent-teacher associations

- Charitable hospitals or other charitable organizations

- Alumni associations

- Schools

- Chapters of the Red Cross

- Boys’ or Girls’ Clubs

- Churches

Other Types of Exempt Organizations

These are tax-exempt organizations but are not tax deductible to your donors. These types of organizations normally rely on member dues and not public contributions. The following are a few that fall under this category. (For a complete list, see page 69): https://www.irs.gov/pub/irs-pdf/p557.pdf).

| Designation | Exemption Description |

|---|---|

| 501(c)(4) | Civic Leagues, Social Welfare Organizations; and Local Associations of Employees |

| 501(c)(5) | Labor, agricultural, or horticultural organizations |

| 501(c)(7) | Social and Recreational Clubs |

| 501(c)(8) | Fraternal beneficiary societies, orders, or associations |

| 501(c)(9) | Voluntary employees’ beneficiary associations |

| 501(c)(10) | Domestic fraternal societies, orders, etc. |

| 501(c)(11) | Teachers’ Retirement Fund Associations |

| 501(c)(13) | Cemetery companies |

| 501(c)(19) | A post, organization, auxiliary unit, etc. of past or present members of the Armed Forces of the United States |

| 501(c)(21) | Black Lung Benefit Trusts |

| 501(c)(23) | Veterans’ Organization (created before 1880) |

REFERENCE

(Feb 2021) https://www.irs.gov/pub/irs-pdf/p557.pdf

How Do You Apply for 501(c)(3) Status for Your Nonprofit Organization?

For your nonprofit business organization to qualify for tax exemption and to receive tax-deductible gifts/donations from donors, you must have a 501(c)(3) status.

To gain the 501(c)(3) status, you apply with the Internal Revenue Service (IRS) by filing the “Application for Recognition of Tax Exemption” Form 1023 or Form 1023-EZ.

Organizations that want to apply for 501(c)(3) status should be aware of the forms required, the user fee, the filing deadline, and the processing procedures.

We are going to assume that you’ve researched the nonprofit organizations in your state, dotted your I’s and crossed your T’s. You’ve completed your assessment and analysis and feel there is a community need for your nonprofit organization. You’ve received your EIN number and you’re now ready to apply for 501(c)(3) status.

You have completed the following:

1. Determined if your organization is one of the following: Trust, Corporation, or Association

- Public Charity or Private Foundation

2. Legally formed nonprofit organization

- Formation date: A corporation is legally formed when its articles of incorporation are filed with the state, an unincorporated association is legally formed when its organizing document is adopted by the signature of at least two individuals, and a trust is legally formed when all non-charitable interests in the trust property expire or when it is funded if there are no non-charitable interests.

3. Incorporated your nonprofit organization (less than 15 months ago)

4. Filed Form SS-4 from www.irs.gov for an Employer Identification Number (EIN).

5. Received your Employer Identification Number (EIN)

6. Reviewed the 501(c)(3) Organization Exemption Requirements – (irs.gov).

7. Verified that your nonprofit organization qualifies as a Tax-exempt, 501(c)(3) Organization by completing the Eligibility Worksheet. If so, you are ready to apply for federal tax-exemption through the IRS site using form 1023 or 1023-EZ.

8. See IRS forms and instructions: About Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code | Internal Revenue Service (irs.gov)

9. Register for an account on Pay.gov

10. Enter “1023” in the search box and select Form 1023.

11. Complete the form. (Don’t include social security numbers)

12. Follow Instructions for Form 1023 (01/2020) | Internal Revenue Service (irs.gov)

13. Pay the fee

14. Stay IRS compliant

REFERENCE

Publication 4220 (Rev. 3-2018) (irs.gov)

Applying for Tax Exempt Status | Internal Revenue Service (irs.gov)

https://www.irs.gov/pub/irs-pdf/p557.pdf

Does a Nonprofit Organization Need to Have the 501(c)(3) Status to Raise Funds?

Nonprofit organizations do not need to have a 501(c)(3) tax-exempt status, but they DO need this to receive tax-deductible gifts/donations from donors. Donors prefer to donate to a nonprofit that will give them a tax deduction for their donation.

Not having the 501(c)(3) status will limit your ability to raise funds or receive government funding and grants. 501(c)(3) status proves it’s a legitimate nonprofit organization which helps when donors are researching the organization before donating.

Obtain Tax Exemption Status From Your State

Once you have your 501(c)(3) federal tax-exempt status from the IRS, you can obtain your state tax exemption.

This isn’t a requirement for every state. Check with your State Franchise Tax Board. For example:

- California Charities and nonprofits | FTB.ca.gov (Form FTB 3500A, Submission of Exemption Request is required for state tax exemption)

- Oregon: If you received your federal tax-exempt 501(c)(3) status, you don’t need to file for Oregon state tax exemption. (There are some exceptions)

REFERENCE

How to Form a Nonprofit Corporation: A 50 State Guide | Nolo

How to Start a Nonprofit Organization (with Pictures) – wikiHow

Tax-Exempt Organization Search

Verify a nonprofit organization with the IRS Tax Exempt Organization Search:

Tax Exempt Organization Search (irs.gov)

- For 501(c)(3) Nonprofit charities and nonprofits

For more information on Payments for Non Profits, check out these resources: Payment Processing for Non Profits

Disclaimer: “The information contained within this blog is strictly for educational purposes, to begin your own research. It is not intended as a substitute for professional or legal advice.

We have made an effort to ensure the accuracy of the information in this eBook at time of publication (05/2022). However, we do not guarantee that all the information in this blog is correct or up to date. Therefore, we disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from information in this blog, negligence, or any other cause.

The blog contains links to external websites that are not provided or maintained by or in any way affiliated with the Company. Please note that the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites.”

Do You Need an Employee Identification Number (EIN)?

Do You Need an Employee Identification Number (EIN)?