You may be interested in accepting credit card payments for your small business but have no idea how it works, where to start, and how to choose the best credit card processor. If so, this credit card processing guide is for you.

In this credit card processing guide, you’ll learn how credit card payment processing works, how it can secure your credit card payments, automate payments, reduce manual processes, and accelerate cash flow so that you can maximize revenue and empower your staff to work more strategically.

To help you understand credit card processing, this guide includes the following information:

-

- Important Factors to know about Payment Processing

- The Evolution of Credit Cards

- The Popularization of Credit Card Payment Processing

- The State of Credit Card Usage

- Entities Involved in Credit Card Processing Ecosystem

- How does Credit Card Processing Work?

- Stages of Credit Card Transaction

- Difference between a Payment Processor and a Payment Gateway

- Understanding the Credit Card Processing Fees

- Credit Card Processing Equipment

- Credit Card Fraud Protection and Security

- How to Choose the Right Credit Card Processor for your Business

- 7 Mistakes You Must Avoid When Choosing Credit Card Processing Services Provider

- Conclusion

- FAQs Related to Credit Card Processing

Table of Contents

- → Important Factors to Know About Payment Processing

- →The Evolution of Credit Cards

- → Entities Involved in Credit Card Processing Ecosystem

- → How Does Credit Card Processing Work?

- → Stages of Credit Card Transaction

- → Difference between a Payment Processor and a Payment Gateway

- → Understanding the Credit Card Processing Fees

- → Credit Card Processing Equipment

- → Credit Card Fraud Protection and Security

- → How to Choose the Right Credit Card Processor for your Business

- → 7 Mistakes You Must Avoid When Choosing Credit Card Processing Services

- → Conclusion: Invest in the Right Payment Process Today

- → FAQs Related to Credit Card Processing

→ Important Factors to Know About Payment Processing

1. What Is a Payment Processor?

A payment processor is a company (often a third party) appointed by the merchant to process various payment transaction types between the merchant and the customer. This service communicates transaction information between the merchant accounts and the customer’s bank. There must be sufficient funds, and the transaction must be valid for the process to begin. Along with checking all security measures, it also ensures the customer’s data is accurate.

Workflow: How It Works

- The customer/buyer submits a payment request from his mobile device, computer, or a mobile payment processor.

- The request then routes the data securely to the acquiring bank.

- Based on the available funds, the acquiring bank will approve or disapprove the transaction. Once approved, the transaction starts.

- The processor stores the transaction and sends the record to both seller and buyer.

- The acquiring bank then releases funds to the seller and the transaction completes.

2. What Is Payment Processing?

Payment processing is an electronic process that allows customers and merchants to automate payment transactions and easily process credit card transactions. These transactions are usually processed, verified, and accepted by payment processors.

3. How Does Payment Processing Work?

Related Read: How Payment Processing Can Help Grow Your Small Businesses

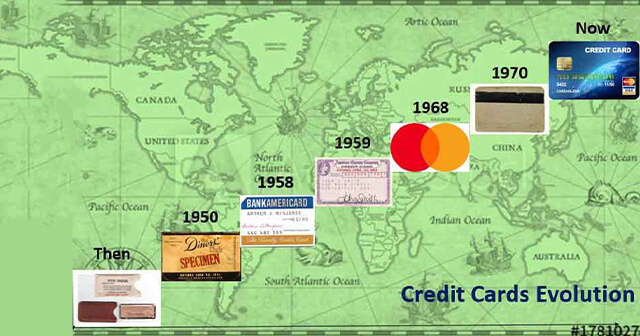

→The Evolution of Credit Cards

The idea of paying with credit has a long history, taking different shapes before American Express issued the first plastic credit card in 1958. Later, in 1994 Stanford Federal Credit Union offered online Internet banking services to all of its members which boosted online transactions and online payment processing came into the limelight.

Source: Credit Karo

Online payments increase productivity and efficiency for businesses and offer new opportunities for international trade to thousands of credit card companies.

→ The Popularization of Credit Card Payment Processing

In the business-to-consumer (B2C) world, businesses of all sizes use card processing to get payments for all goods and services. Due to their convenience, simplicity, speed, and reliability, credit card payments are one of the most popular payment methods.

→ The State of Credit Card Usage

U.S. consumers, on average, use 25.3% of their credit card limits. People belonging to Generation X have the highest average revolving credit utilization rates at 31% (as of May 2020).

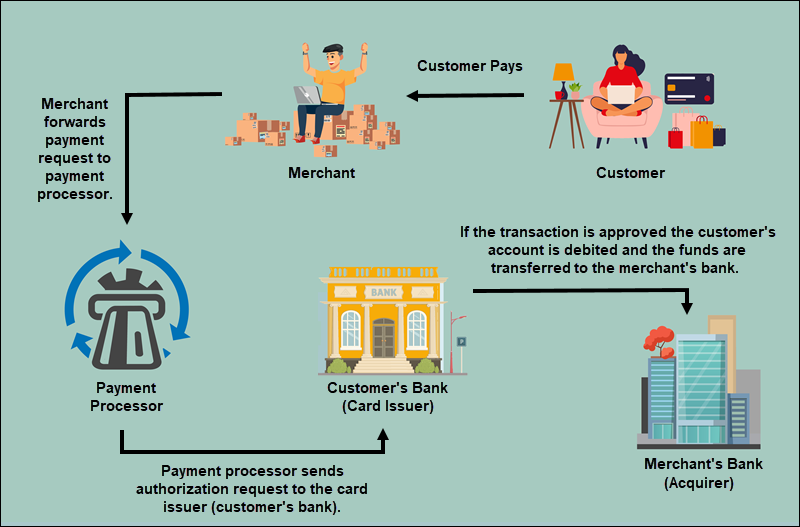

→ Entities Involved in Credit Card Processing Ecosystem

- Customer: The cardholder or the person who made the purchase.

- Merchant: The person or business who sells a product or service.

- Acquiring Bank: This is also known as the merchant bank (where the money goes). Merchants use this bank to hold their business funds and receive money from transactions. The company can provide the merchant with card readers and equipment to accept payments.

- Issuing Bank: Also known as the “cardholder’s bank” or the “customer’s bank.” This is the financial institution (the bank that provides the credit card to the customer.) The primary role of the issuing bank is to determine whether the card holder’s account contains the funds needed to complete a transaction so that those funds can be released for settlement.

- Credit Card Network: MasterCard, Visa, American Express, and credit and debit card networks facilitate transactions between card issuers and merchants.

- Payment Gateway: It’s a processing network that easily communicates through the internet to send and receive payment information between issuing banks, credit card associations, and merchants. The payment gateway approves purchases, detects fraud, and ensures you receive all your funds from the transaction. It can be found at most retail POS (points of sale) stations.

- Payment Processor: Also known as a “credit card processor”, it facilitates communication between a merchant, a card network, and a cardholder’s bank and processes credit card transactions through a payment gateway. Processors and merchants must comply with Payment Card Industry Data Security Standards (PCI DSS).

The processors offer many benefits:

- Ensures the security of financial data transmission according to PCI DSS.

- Accepting credit cards through all payment methods.

- Helps merchants dispute chargebacks.

- Offers multi-currency, real-time currency conversions, and bulk payments.

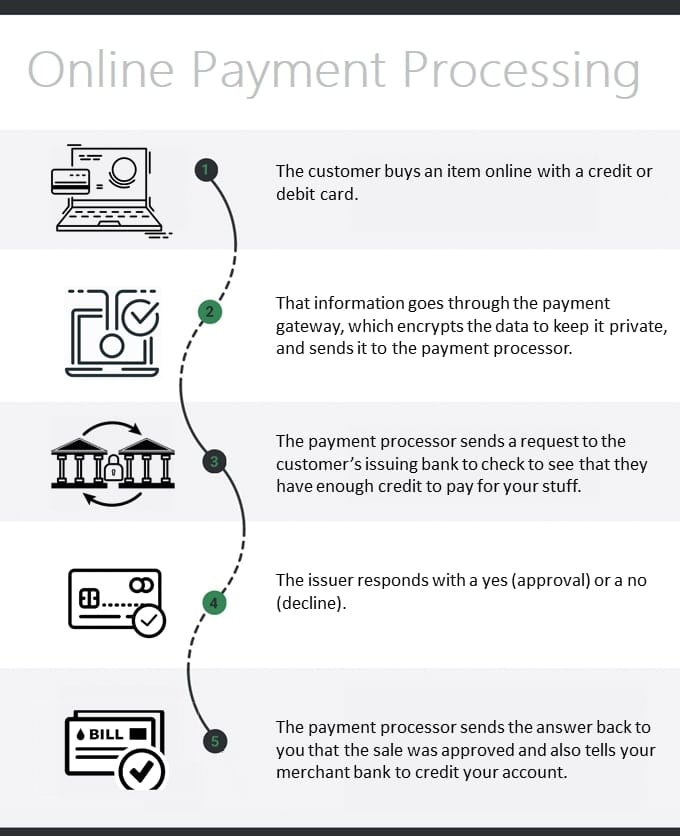

→ How Does Credit Card Processing Work?

- Step 1: Merchant takes the credit cardholder’s payment information at the card terminal (with a chip, magnetic stripe swipe, or through the contactless tap), over the phone, or online.

- Step 2: Credit card processor directs the card info to the credit card network via an internet connection through a payment gateway.

- Step 3: Then, the payment gateway sends the transaction data to the issuing bank to request authorization via card networks.

- Step 4: Once the customer’s bank validates the payment, it authorizes the transaction amount. Then, the authorization gets sent back to the merchant. (Note: If there are inadequate funds or suspicion of fraud, the transaction will be denied.)

- Step 5: After the transaction is authorized, a hold is placed at the issuing bank for the amount.

- Step 6: Then the merchant settles a batch of transactions (usually once per business day).

- Step 7: After that the issuing bank releases the funds to the acquiring bank.

- Step 8: Funds are deposited into the merchant’s bank, minus any interchange and processor fees.

→ Stages of Credit Card Transaction

Let’s check the detailed stages of a credit card transaction in detail:

Stage 1: Authorization

The authorization ensures that the party involved in the payment processing process is entitled to participate in it. Here’s how the process works:

- The cardholder or customer provides their credit card details (card number) to the merchant. The seller puts that card number on the dashboard and a request for payment is carried out from the gateway. The brick-and-mortar also uses the POS terminal to accept payment requests.

- The merchant forwards the payment request to get authorization from the respective processor. If the buyer pays for the goods and services through any other wallet like Apple Pay or Google Pay, the merchant then submits the transaction information to the wallet operator, and the data is forwarded to the processor.

- The processor then delivers the transaction request to the respective card provider with the issuing bank.

- The issuing bank receives the authorization request containing the credit card details to be used in the transaction.

- The issuing bank will then confirm the transaction to decline or process.

- The approval or denial is sent by the issuing card bank, merchant bank, and to the merchant. If the transfer gets rejected, it might be because of expired payment date and card verification value (CVV) or an issue with the address verification services (AVS).

Stage 2: Settlement and Funding

Settlement is the final stage during which the merchant receives the amount of money that the customer pays for purchasing the goods and services. Payment processing participants handle the statement in the following ways:

- The merchant sends a complete batch of authorized payments to the processor.

- The payment processor forwards the transaction data to the card association.

- The card association notifies the relevant bank within the network of the requested debit.

- The issuing bank debits the cardholder’s account with the requested amount for the payment.

- The requested funds are then transferred to the merchant bank by issuing bank. At this stage, you will also pay interchange fees.

- The merchant bank then credits the merchant account with the funds.

Stage 3: Credit Card Interchange

Credit card interchange fee is referred to as the settlement and clearing of the payment data, in which the bank initiates the approval card payments for its merchant account.

The below-given graphical representation will help you understand the stages of a credit card transaction quickly:

→ Difference between a Payment Processor and a Payment Gateway

As we have discussed above, the entities involved to process credit cards transactions, the ones that are crucial for making a secure and fast transaction for your business, are a Payment Processor and Payment Gateway.

Now, generally speaking, both the terms are interchangeable; however, there are some important distinctions to remember. Let’s talk about them in detail:

| Payment Processor | Payment Gateway |

| Payment processors process and send payment information. | Payment gateways perform the task described and verify the cash transfer between customer and seller. |

| Payment processors deliver important data, such as the credit, debit, or credit card number, to the issuing bank. | The gateway is regarded as the general infrastructure at the level of purchase: the symbolic cash register. |

| A payment processor includes both a hardware and a digital component | A gateway requires more than hardware and other processing equipment. |

→ Understanding the Credit Card Processing Fees

The impressive benefits of credit cards often come with a price you need to pay with every transaction. However, the amount or the fee may vary between the type of processor and their respective pricing models.

Generally, a processor charges some percentage of every transaction, adding a few other costs like a statement fee, flat fees, or a minimum monthly cost in the merchant fees. Let’s discuss some of the most common fees associated:

- Interchange rates: These are fixed fees that issuing banks collect for the transactions (the rates are set by the card companies). Also called a Swipe fee, the network will collect the interchange fees when someone swipes a card (debit, credit, or business).

- Assessment fee: This is the total monthly processing fee for every card brand and is paid directly to the card associations.

Other Fees or Charges:

- Markup fees: These are given to the processor after every transaction.

- Flat fee: This is a fixed flat fee charged on a monthly basis for using the platform and services of the processor.

- Monthly Minimum Fee: Some processors let you process a minimum amount every month to avoid fees adding to your bill.

- Chargeback fee: A chargeback in a pricing model often occurs if a customer disputes a charge and results in a refund.

Must Read: Payment Processing for Nonprofits: The Essential Guide [2023]

→ Credit Card Processing Equipment

What payment processing devices will you use for credit card transactions? Understanding the equipment used to process your payments is essential because you will connect through credit card processing equipment.

You should also consider two things when choosing equipment: First, what your processor supports. Second, for what purpose would you use the credit card (for offline or online purchases).

→ 4 Best Equipment Types for Credit Card Processing:

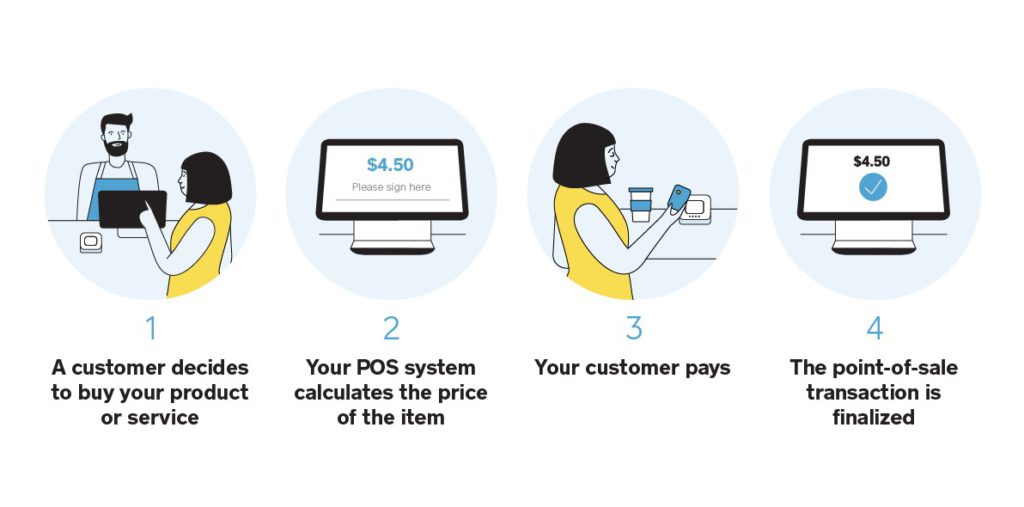

- Point-of-Sale “POS” System

- Virtual Terminal

- Mobile / Wireless Terminal

- Click-to-Pay Email Invoicing

Let’s discuss in detail;

1. POS System:

The point of sale software systems (POS) are commonly used in restaurants and retail shops. It is used to handle credit card payments, manage inventory, and coordinate between stores.

This system is also ideal for collecting customer information for long-term retention. POS comes in many forms so make sure you do your research before making the purchase.

2. Virtual Terminals:

Virtual terminals are credit card software that runs online. You can log into the secure portal through any internet-connected device to access these terminals. A virtual terminal enables you to process a single credit card through the portal quickly.

3. Mobile/Wireless Terminal:

Mobile devices are used interchangeably to describe any app-based transaction where the mobile device acts as a terminal. It is used to connect you to the processor to initiate the transactions. The process of credit card transactions can be accessed in two ways, you can either manually add them into the app or swipe/dip/tap them through the physical hardware attached to the smartphone.

A wireless terminal is just like the countertop terminals; you need a connected internet or mobile subscription to process any transaction.

4. EMV:

Source: Thales

EMV is a credit/debit card that comes with an embedded security chip on it. It replaces the magnetic stripe on the back of the card as a secure alternative. Additionally, to keep the customer’s information encrypted and secure, EMV tokenizes the data of the credit card.

→ Credit Card Fraud Protection and Security

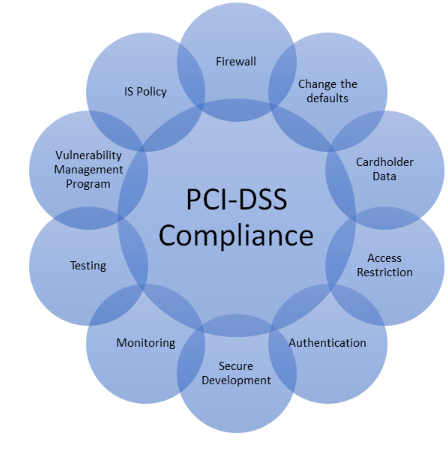

1. PCI DSS Compliance:

PCI DSS or the Payment Card Industry Data Security Standard, is the set of security regulations developed by MasterCard, Visa, JCB International, American Express, and Discover Financial Services in 2004.

This compliance set an operational and technical standard for the firms that accept credit card payments or process online transactions for software, and manufacturers of applications and devices that are used in those transactions.

Source: Breach Lock

With the prime goal of maintaining and providing secure online transactions, the PCI DSS helps in decreasing fraud and online security breaches.

There are 12 main requirements for PCI DSS compliance that apply to merchants and credit card processing services:

- To Protect the system with firewalls

- Configuring passwords and settings from your bank account

- Protecting all the stored cardholder data

- Encrypting the transmission of cardholder data across open, public networks

- Using and regularly updating anti-virus software

- Updating the patch systems

- Limiting the access to cardholder data

- Assigning a unique ID to each person with computer access

- Restricting physical access to workplace and cardholder data

- Implementing logging and log management

- Conducting vulnerability scans and penetration tests

- Documentation and risk assessments

2. SET (Secure Electronic Transaction):

SET is a collaboration by VISA and MasterCard that ensures the safety of all parties that are involved in transactions that are online. It is used to handle critical functions like:

- Confidentiality of information and payment data

- Define protocols and electronic security services, providers

- Authenticating the cardholder and merchant’s bank account

3. Encryption:

Encryption is a method that helps to conceal the information in the codes, which looks like random data but is difficult to decode. Encryption is of different types; the choice of technique depends upon the type and the context of the requirement. Some of the most common encryptions techniques are:

- Public key encryption

- Symmetric key encryption

4. SSL (Secure Socket Layer):

SSL is another most popular and widely used security measure that provides security over internet communications. It acts as a secure communication layer between the machines operating online. It supports security protocols like authentication and encryption and also ensures that the requested and submitted data is safe and gets delivered.

SSL is also used to secure all types of transactions that are made from your bank account like online banking, credit and debit cards. SSL protocol is also developed to prevent online security breaches that occur when transmitting data online.

5. S-HTTP (Secure Hypertext Transfer Protocol):

S-HTTP is an execution of hypertext Transfer Protocol that allows the secure exchange of files over the internet. The S-HTTP provides an added layer of security that lets customers send a valid certificate to authenticate the user through public encryption and digital signatures.

The S-HTTP secured websites are safe and can seamlessly integrate with the HTTP providing the endpoint security to make transactions completely safe and secure.

Related Read: Payment Processing Security: 7 Things to Consider

→ How to Choose the Right Credit Card Processor for your Business

Choosing the best credit card processing services for your business needs good research. You need to ask the right questions to ensure that the processing company adheres to your business needs and will protect your client’s data.

Here are some tips that you can follow to get the best solution from a credit card processing company:

- Look for the credit card processing cost that the processing companies charge

- Identify the setup process

- Ask if they accept credit cards of all the banks

- Check all the fraud prevention measures

- Identify customer support

- Merchant services

→ 7 Mistakes You Must Avoid When Choosing Credit Card Processing Services

- Thinking that the lowest rate is the ‘lowest overall cost’

- Losing fast access to your money

- Not giving a full range of payment options

- Not being vigilant against the suspicious buyers

- Underestimating the importance of data security

- Taking PCI compliance on your own

- Not thinking about the support or setup availability

Let’s discuss these mistakes in detail:

Mistake 1: Assuming the Lowest Rate = Lowest Overall Cost

Finding the lowest rate seems simple unless you notice some asterisk. This means there’s a fine print with the clause that alerts you of higher processing costs, which you will pay as transaction fees.

This increase in rates won’t just cut your margin, but will also turn the profitable transaction into an unprofitable one.

Why is it difficult to find the actual lowest rate?

Most processors often charge different rates depending upon various factors like how the transaction is processed, and the type of credit card used. As a result, the actual transaction fees you pay to the processor increase more than the advertised rate. So, how can you control the transaction fee?

One method of keeping an eye on the processing is to track the breakdown in your customers’ card usage and count the estimated processing fees. With the estimated amount you can have an idea of the effective rate that you actually pay. You may also consider a processor that offers flat-rate processing and charges you one rate instead of putting transactions into tiers.

Mistake 2: Losing Access to your Money

We have all heard horror stories like, “A successfully running online business suddenly goes down because they have to investigate suspicious activity and the merchant account needs to freeze.”

In the previous days of online payments, such stories were quite common, but today working with the payment processor to monitor fraud and to clear sales has become a straightforward thing.

Additionally, any time loss in accessing the customer’s payment can create problems for customers. So, look for someone that provides you quick access to the profits you earn from online sales.

Mistake 3: Not Providing a Full Range of Payment Options

Today’s customers expect more options; the more payment options, the better your chance of acquiring sales. Some customers don’t agree to use credit cards online despite the secure payment processing.

Offering various trustworthy options like credit cards will help you reduce cart abandonment and attract more customers to increase sales.

Mistake 4: Not Getting Protection Against Bad Buyers

The majority of people who buy your products are just looking for a good deal, but there will be fraudsters looking to intervene in the process. You may also receive an unauthorized payment from fraud using a hacked credit card account.

You can either absorb the cost of refunding the authorized payments or exchange the item for your customers. Many merchants consider these unauthorized expenses as a part of doing business. However, over time these may add up to your overall cost.

So, rather than simply jumping to calculate the cost, try working with the vendor that protects your business from fraudulent transactions.

Mistake 5: Underestimating the Importance of Data Security

Stealing customers’ data from retailers like credit card information and personal information is big business for cybercriminals. It’s important for merchant services providers to look for a payment gateway that offers a secure, reliable processor. As you evaluate vendors, look for the one that will help you protect your online business and customers from fraud.

Mistake 6: Handling the PCI Compliance on Your Own

Another reason why you must worry about customer data security is compliance. Online merchants often spend a lot of money and time tackling security on their own by developing strong payment card security processes. Working with the data processor that keeps your customer data encrypted will help you reduce your workload around the PCI compliance requirements.

Mistake 7: Not Thinking About the Ease of the Setup or Support Availability

Setting up payment processing requires technical knowledge, so if you do it on your own, you may run the risk of frustration, lost customers, and loss of time.

So, find payment processors that offer solutions that are easy to get up and resolve the issues. Also, think of the credit card processing companies that offer around-the-clock solutions and technical support.

→ Conclusion: Invest in the Right Payment Process Today

Credit card processing is crucial for starting your first business or supporting an established enterprise. Learning about the latest technology can help reduce manual accounts receivable processes, reduce payment fees, and accelerate payment collection. Credit card processing that is secure, fast, and reliable helps you improve your bottom line in the short and long run by removing unwarranted stress and saving time and money.

Maximize your profits with GETTRX Zero credit card processing services. Our zero-fee solution offers quick, secure and reliable transactions to help you save money and grow your business. Contact us today!

→ FAQs Related to Credit Card Processing

Qn 1: What Is a Credit Card Payment Method?

A credit card payment method is a process in which a credit card network receives payment details from the acquiring processor. This request is then forwarded to the issuing bank and sends the issuing bank’s response to the processor.

Qn 2: What Are the Methods for Processing Credit Cards?

- Credit Card Imprinting Machines: The simplest way to process credit card transactions is also the one that’s been around the longest.

- Bank Processing: One of the most straightforward ways to process the payment is to ask your bank. Many banks will make these payments for organizations that have merchant accounts. The payments are then deposited into the merchant account and can make payments through a regular bank account. Also, if you make your payment in the form of paper, bank processing always makes a lot of sense.

- Mobile Devices: Mobile devices are the best alternative to portable credit card terminals, smartphones, and other mobile devices. In this, you either have to manually enter the card details or extra hardware for swiping the card. A mobile device has the advantage of portability as it allows you to process transactions from any location from your phone.

- Credit Card Terminals: If you need to process a high volume of payments on-site, you can invest in a credit card terminal, also called a swipe terminal. These terminals allow you to swipe a credit card and enter the payment amount on the keyboard. You can buy them from the bank that hosts your merchant account. You may need terminals for the power source or a connection to process credit cards in real-time.

- Swipe Hardware: To save time over manually entering the credit card transaction, you need hardware that lets you swipe the cards. From the basic to the small card reader, you can choose any device to process transactions.

- Virtual Terminals: A virtual terminal allows you to enter credit card payments information into an online form and process it over the Internet. These terminals don’t show swipe hardware and thus require you to enter credit card information manually. However, they are one of the most convenient methods for processing payments.

- Online Payment Processors: Various online payment vendors specialize in various types of online payments. While these vendors provide an interface optimized for your constituents to submit payments and also allow them to process payments, keep in mind that unless you use compatible simple hardware, you need to type in your credit card information.

- Payment-Enabled Software: If you are processing payments that need to get done with interface only.

Qn 3: What is an ISO for Credit Card Processing?

An ISO (independent sales organization) is a company that acts as an intermediate between merchants and the acquiring banks that takes in the payments from credit card transactions. The ISO serves a number of functions, including finding new merchant clients on behalf of the acquiring banks and major payment processors, processing the transactions put through by small businesses, and, in many cases, providing support and customer service to merchants for the lifetime of their relationship with the ISO.

Q 4: How do I Process a Manual Credit Card Transaction?

Manual payments are done by manually entering the transaction amount and details of customers. To manually process the transaction, here are steps you must follow:

- Go to your credit card terminal with the customer card information

- Enter the card details manually

- Enter the CVV number and card details

- Enter the amount to be charged

- Click charge

Q 5: How Do I Process a Credit Card Without a Merchant Account?

To accept credit cards online without a merchant account is not impossible. However, you will need to find a third-party payment provider to work with. These companies can process customers’ credit card payments for you and simply transmit the amount to your account.

Qn 6: What Is Offline Credit Card Processing?

An offline debit card is not connected to an online system when used. Funds are therefore withdrawn from an account 24 to 72 hours later. An offline debit card does not require a PIN for use, only a signature, and can be compared to writing a check.

Qn 7: How Can I Save Money on Credit Card Processing?

- Use address verification services

- Properly set up the account

- Negotiate with the processor

- Minimize the risk of credit card fraud

- Consult with an expert

For more information on Payment Processing, check out these resources: Payment Processing Basics, The Importance of Payment Processing, Payment Processor vs ISO.