Automated Clearing House (ACH) transactions are electronic payments that move directly between bank accounts.

ACH can benefit businesses in many ways. These payments are secure, and they cost less than other transaction types. By adding ACH payments, you can introduce things like subscription services and installment payments.

If your processor doesn’t offer this kind of payment, it can limit your business and raise your costs.

We’re excited to share that our GETTRX One™ platform now lets users make and accept ACH payments. Users can perform both credit and debit transactions through the EdgePay gateway on the platform.

In addition to these payment types, you gain access to our full suite dashboard. On it, you can track every transaction and simplify your reporting and analytics tasks.

Table of Contents

Important ACH Terms

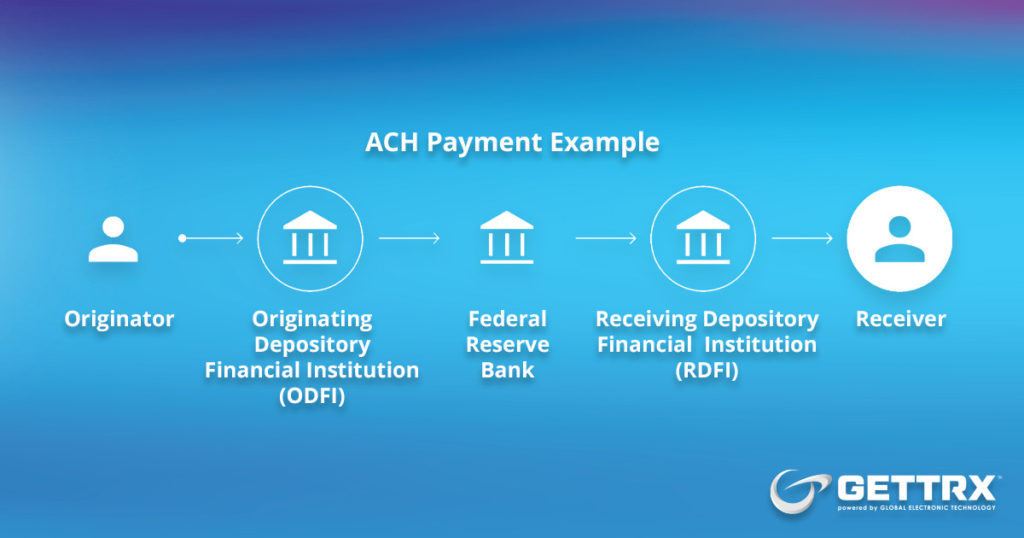

Originator

The originator is the party that creates the credit or debit transaction. The transaction can only move forward if a receiver has authorized it.

Receiver

The entity that authorizes the transaction. One example of a receiver is an employee who enrolls in their company’s direct deposit.

ACH Credit Transactions

ACH credit transactions can be thought of as “push” transactions. They enable the originator to push funds to the receiver. This can be a cost-effective and secure way to arrange important recurring charges a business covers.

ACH Debit Transactions

Debit transactions are considered “pull” transactions. They enable the originator to pull funds from the receiver.

NOTE: For debit and credit transactions, the originator must receive and retain proof of the receiver’s authorization.

Originating Depository Financial Institution (ODFI)

The ODFI is the financial institution responsible for processing ACH transactions submitted by the originator.

Receiving Depository Financial Institution (RDFI)

The RDFI is the financial institution that receives the credit or debit and posts it to the receiver.

National Automated Clearing House Association (Nacha)

Nacha is a third party agency that oversees the ACH network. They maintain all the rules and regulations that support these transactions, and they impose penalties when necessary. Their work makes making and taking ACH payments safer.

The standards set by Nacha have an important role to play in the security of the network. They minimize risks involved in moving money directly from one account to another by setting and maintaining guidelines.

GETTRX™ is Nacha Certified as a third-party sender. Because of this, the company can help users stay fully compliant and secure.

SEC Codes and ACH Payments

Standard Entry Class (SEC) Codes define different payment types. The codes identify the type of transaction made. Nacha maintains separate rules for each code.

The following codes refer to ACH payment types supported on the GETTRX One™ platform:

- Corporate Credit or Debit Entry—CCD

- CCD transactions refer to the transfer of funds between businesses. They’re also used in the consolidation of funds from multiple accounts belonging to the same business.

- Prearranged Payment and Deposit Entry—PPD

- PPD transactions refer to single or recurring entries for direct deposits. They are used for payroll deposits and pension payments as well as recurring bill payments.

- Telephone-Initiated Entry—TEL

- TEL transactions refer to single or recurring entries made after oral authorization from the receiver was obtained via telephone.

- Internet-Initiated/Mobile Entry—WEB

- WEB transactions are single or recurring entries made after oral authorization is obtained via the internet or mobile device. In the case of a consumer-to-consumer credit, the authorization can come from any method.

The ACH Flow

- The receiver authorizes the transaction with the originator.

- The originator sends the payment to the ODFI for processing.

- The ODFI receives the payment details and sends them to the Federal Reserve Bank for distribution.

- The Federal Reserve Bank distributes them to the RDFI.

- The RDFI is responsible for debiting or crediting the receiver, depending on transaction type.

How ACH Helps Businesses

ACH payments benefit businesses because they are secure and cost less than wire transfers. They can result in fewer failed charges. For recurring transactions especially, ACH can be safe, cheap, and reliable.

ACH can also help lower costs and reduce administrative challenges for repeated transactions where companies need to send money. This makes it appealing as a way to manage monthly bills and direct deposits.

To maintain access to ACH transactions, accounts will need to comply with Nacha rules at all times. This includes rules on minimizing returns on payments.

NOTE: Not all businesses are approved for ACH operations. These include:

- Internet gambling

- Debits related to pornography or any other “adult” activity

- Internet, mail, or telephone sales of tobacco

- Telemarketing

- Multi-level marketing

- For-profit debt relief service providers

Our GETTRX One™ Platform Allows for ACH Payments and Much More

GETTRX One™ simplifies payments by offering more payment methods and holding all of your payment data. Including ACH will give users more opportunities to save on transactions and give merchants more payment choices.

GETTRX One™ is also available as a white-label solution for payment processing ISOs and agents. You can offer all of its features while also enjoying its enhanced online onboarding capabilities and portfolio reviews.

GETTRX One™ also works as a payment solution for ISVs and SaaS companies that wish to monetize payments.

FAQs

What makes ACH different from other payment methods?

- ACH enables payments between bank accounts without the need for a check, card, or wire transfer. This method of transferring funds offers security and lower costs, making it popular for recurring transactions.

What can I do with ACH?

- ACH provides the means to perform credit and debit transactions. Credits “push” funds out, making them popular for direct deposits and monthly bills. Debits “pull” funds in. Companies often use them to offer things like subscription services and installment plans.

Is this a safe payment option?

- Nacha creates, monitors, and enforces all rules around ACH payments. GETTRX™ is Nacha Certified as a third-party sender.

How do I manage my ACH transactions?

- Because GETTRX One™ is a full suite solution that lets users review all card and digital transactions from one dashboard. This means you can check on card, ACH, and digital wallet transactions on the same intuitive platform.

Talk to GETTRX™ About Introducing ACH Payments to Your Business

ACH payments help business owners save money and offer more attractive payment types. Their inclusion on GETTRX One™ adds another benefit for merchants and payment processors. To learn more about our platform and the inclusion of ACH, call us at 888.775.1500 or email info@gettrx.com.