Payment collection has proved challenging as business trends become more complex and customer engagement channels increase. Payment facilitators are a central pillar of successful businesses, and in this guide, we’ll cover everything there is to know about the topic.

Here are some of the key points we will cover in this blog;

- What is a payment facilitator?

- How does the payment facilitation model work?

- What are the primary functions of payment facilitation?

- What are the challenges of becoming a payment facilitator?

- What is PayFac-as-a-Service, and how can it help companies overcome common payment facilitation challenges?

Table of Contents

- What is a payment facilitator?

- How does the payment facilitator model work?

- What are the primary functions of a payment facilitator?

- What are the challenges of becoming a payment facilitator?

- What is payment facilitation as a service?

- What are the benefits of payment facilitation-as-a-Service?

- FAQs related to Payment Facilitator

What is a payment facilitator?

A Payment Facilitator, aka PayFac, is a service provider for merchants.

A payment facilitator is an entity that helps companies accept electronic payments from customers via multiple channels by quickly onboarding them as sub-merchants. Thus, the company can use PayFac’s infrastructure to easily collect payments from its customers while PayFac manages all administrative and technical aspects of the infrastructure.

For instance, a SaaS platform that helps accountants manage their business can build or integrate a PayFac and offer payment acceptance options to its clients. In addition, the platform monitors transaction flow and conducts fraud checks through its PayFac module.

Payment facilitators ease the burden of payment collection. As discussed in this guide, you can build a PayFac in-house or leverage third-party expertise.

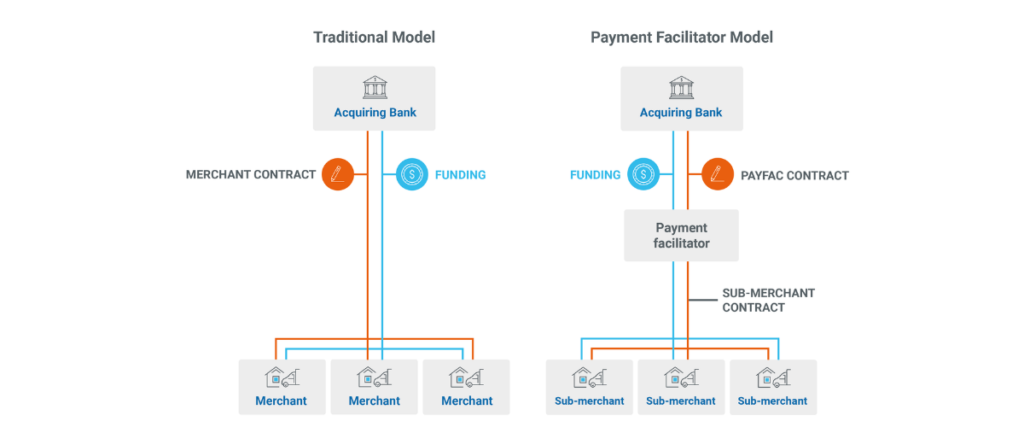

How does the payment facilitator model work?

The payment facilitator model simplifies the way companies collect payments from their customers. It also helps onboard new customers easily and monetizes payments as an additional revenue stream.

Source: Google Images

Here are the key players in the chain and their roles in the facilitation model;

1. Payment Facilitator [PayFacs]

PayFacs manage the back-end processes associated with online payments. For instance, they provide merchants with payment infrastructure, maintain payment channels, and secure all associated technology.

Most PayFacs provide payment analytics that helps merchants analyze cash flow trends in their accounts, payment channels, and customers.

Thanks to additional services like fraud checks and seamless integration with third-party apps, PayFacs are a one-stop-shop for everything connected to payment acceptance.

2. Sub-merchants

A sub-merchant is a company that uses a PayFac to offer customers online payment channels. For instance, a SaaS vendor that offers its clients the ability to collect credit card payments is a PayFac, and its clients are sub-merchants.

PayFacs verify a company’s documents before onboarding. These checks are necessary to fulfil KYC and AML norms and minimise fraud and secure the online shopping experience.

3. Banks

A bank lies behind a PayFac, conducting checks on the latter’s compliance, sub-merchant onboarding procedures, and business practices. Before offering customers payment methods from popular card networks (Visa, Mastercard, etc.,), a PayFac must create an account with a sponsor bank.

The bank receives data and money from the card networks and passes them on to PayFac. In the PayFac model, banks that monitor PayFacs are called Acquiring Banks.

4. Payment processors

Payment processors work in the background, sitting between PayFac’s sub-merchants and the card networks. Here is a step-by-step workflow of how payment processing works:

- A customer initiates a payment to a sub-merchant using a credit card

- The processor receives the payment authorization request, validates it, and sends it to the card networks

- The card network verifies the transaction and sends an authorization response to the processor

- The transactions are settled by the processor daily and sent to PayFac’s bank

- After validation, PayFac’s bank transfers money to the Sub-merchant’s bank

An acquiring bank might host a payment processor, thus combining multiple services under one roof.

Related Read: Trends in the Payment Industry for 2022

What are the primary functions of a payment facilitator?

Here are some of the most important functions of payment facilitation.

1. Platform access

Payment facilitation helps you offer your clients payment collection methods without experiencing the hassle of setting up multiple payment gateways and other infrastructure.

For instance, marketing agencies using an ISV that helps them manage their business can quickly accept customer payments without configuring payment gateways. Payment facilitation helps them grow their payment infrastructure in line with their businesses.

2. Monitoring financial compliance

Banks are bound by law to monitor their clients’ financial transactions and ensure they do not flout Know-Your-Client (KYC) or Anti-Money Laundering (AML) laws.

Payment facilitators simplify this process by using technology to define KYC and AML rules and flag suspicious merchants and transactions. PayFacs routinely checklists such as the one maintained by the U.S Office of Foreign Asset Control to screen for fraudulent companies.

Compliance monitoring is one of payment facilitation’s central pillars.

3. Monitoring account activity

Payment facilitation processes flag suspicious transactions, including within customer activity. For instance, a customer that initiates fraudulent transactions from a cluster of IP addresses is automatically flagged, thus protecting the merchant.

PayFac places controls and thresholds based on historical activity on each account. Thanks to sophisticated algorithms, they can easily flag potentially high-risk financial activity.

4. PCI compliance

Payment Card Industry or PCI compliance is essential when accepting card payments from customers online. The card industry uses PCI guidelines to define customer data handling procedures, storage, and data encryption standards.

Merchants that wish to accept online card payments must install workflows and infrastructure to help them achieve compliance. PayFac simplifies this process by validating its systems for compliance and offering smooth integration to merchants.

What are the challenges of becoming a payment facilitator?

You can apply to become a payment facilitator with a bank and begin offering your customers the ability to collect online payments. However, the process of becoming a payment facilitator brings many challenges.

Here are some of the biggest obstacles to setting up payment facilitation in-house:

1. High costs

The prohibitive cost of setting up payment facilitation infrastructure often stops in-house projects in their tracks. Compliance monitoring and registration contribute the majority of costs. For instance, setting up PCI compliance and validating these processes costs anywhere from $50,000 to $500,000.

Furthermore, merchant management systems that can handle disputes and manage payouts cost over $500,000. Installing underwriting policies, identity verification, and card network compliance monitoring cost at least $600,000. These costs do not include ongoing maintenance costs that can add up to $800,000 or more.

2. Non-core expertise

While payment facilitation setup and maintenance costs are high, sourcing the right expertise to maintain infrastructure and remain abreast of the latest industry developments is a significant challenge. Should you build a PayFac in-house, you must devote resources to strengthening functions unrelated to your core business.

For most companies, this vision is unrealistic and will harm their primary businesses.

3. Changing regulatory landscape

Payment industry regulations change fast, and PayFac’s infrastructure has to keep pace. For instance, some jurisdictions are still defining what a PayFac is. As these definitions change, companies must invest resources to adhere to new regulations.

The technological environment is changing as well. Local laws define different infrastructure requirements that can increase costs significantly. For instance, infrastructure requirements to facilitate SEPA payments in the EU differ from those to accept payments via Alipay in China.

Companies find that keeping track of these changes and updating infrastructure can be time-consuming.

4. Scaling

The biggest benefit of moving online is the ability to cater to customers worldwide. However, before accepting payments from all corners of the globe, you must adhere to local payment facilitation laws and requirements.

A solution that works in the United States might not work for the E.U. Thus, scaling an in-house payment facilitation solution is tough. Companies with revenues of many multiples of the costs we previously listed find it feasible to scale their solutions.

What is payment facilitation as a service?

Payment-facilitation-as-a-service, or PayFac-as-a-Service, as it’s often called, helps companies become payment facilitators and onboard merchants onto their platforms quickly. Payment facilitation as a service helps software platforms achieve quick go-to-market times and avoid the hassle of applying for merchant accounts.

For instance, a SaaS app that helps web designers manage all aspects of their business can leverage Payfac-as-a-Service and offer payment management as a module to its clients.

The app instantly adds value for its users and avoids the costs and lengthy approval timelines that come with building payment facilitation in-house.

What are the benefits of payment facilitation-as-a-Service?

Payment-facilitation-as-a-service unlocks multiple benefits for software platforms and any company dealing with merchants. Here are 6 of the biggest ones:

- Cost-effective infrastructure: An instant upgrade to industry-standard best practices, product upgrades, and security for a monthly price without building expertise in a non-core business area.

- Faster time to market: PayFac-as-a-Service reduces customer acquisition costs and allows you to market quickly in your industry verticals.

- Compliance simplified: PayFac service providers ensure their infrastructure and technology are state-of-the-art and always adhere to changing industry standards. Thus, the payment infrastructure you offer your clients is always state-of-the-art.

- Create great products: You can onboard customers quickly, simplify KYC and AML compliance, and offer more value through great user experiences.

- Greater revenues per user: Adopting PayFac-as-a-Service instead of choosing a subscription boosts your gross margins and helps you own the entire user journey.

- Powerful analytics: PayFac-as-a-Service helps you manage merchants from a single dashboard, generate insightful reports, and spend less time chasing paper when resolving disputes.

Curious about how a payment facilitation service provider can boost revenues, help you retain more customers, and decrease customer acquisition costs? Get in touch with us.

Qn 1: What is PayFac-as-a-Service?

Payment Facilitation as a Service or PayFac-as-a-Service enables software platforms to monetize payments and onboard new users instantly. The platform functions as a master merchant account that can be used to set up sub-accounts for end users immediately.

Qn 2: What is a payment facilitator?

A payment facilitator, also called a PayFac, is an entity that helps companies accept electronic payments from customers via multiple channels by quick-onboarding them as sub-merchants. Thus, the company can use PayFac’s infrastructure to easily collect payments from its customers while PayFac manages all administrative and technical aspects of the infrastructure.

Qn 3: What are the roadblocks to implementing payment facilitation in-house?

Companies must apply for merchant accounts with acquiring banks to facilitate payments for their merchants. Some of the roadblocks in this process are:

- High application and infrastructure costs

- High compliance costs

- Changing regulatory landscapes

- Allocating resources to non-central business functions

Qn 4: What are the benefits of payment facilitation-as-a-service?

Some of the benefits of PayFac-as-a-Service are:

- Cost-effective infrastructure

- Faster time to market

- Simplified compliance

- Memorable products with great user experiences

- Increased revenues per user

- Data-driven insights through powerful analytics

Qn 5: Why is payment facilitation important for ISVs?

Payment facilitation helps ISVs create attractive platform offers that attract merchants and boost revenues. ISVs can create end-to-end solutions that increase value for merchants, helping them upgrade their payment infrastructure and access a one-stop shop for their compliance needs.

For more information on Payment Facilitators, check out these resources: Risks Payment Facilitators: A Guide & Payment Facilitator vs Payment Processor