2023 is an exciting year for the payments industry, with a range of new trends emerging that will shape how consumers and businesses make payments. From Buy Now, Pay Later (BNPL) services to embedded payments and Peer-to-Peer Payments, there are several innovative payment solutions that businesses should be aware of to stay competitive.

Gen Z-focused payment options are set to become increasingly popular in 2023 as more adult Gen Zers enter the market. Account-to-account (A2A) payments will also become a consumer payment option, allowing customers to transfer funds directly from one bank account to another. Additionally, Open Banking payments are becoming more prevalent, with variable recurring payments (VRP) likely becoming popular for businesses.

Overall, 2023 promises to bring exciting changes and opportunities for businesses in the payments industry. Businesses can remain competitive in this ever-evolving digital payment processing landscape by staying current on the latest trends and embracing innovative solutions such as embedded payments and A2A transfers.

Let’s get into the latest payment industry trends for 2023:

1. Biometric authentication:

Biometric authentication is not an entirely new concept in the payment industry, as it has been used in some form or another for centuries. Biometric authentication is the security process that verifies users’ identity through a unique biological trait like voice, facial characteristics, retina, and more.

It traces this unique data to verify a user’s identity when that user accesses the account. Since the data is unique for every user, biometric authentication is more secure than the traditional form of multi-factor authentication. Biometric systems are sophisticated enough to authenticate one person from another with over 99% accuracy.

2. Mobile POS devices:

Mobile POS is a Portable Point of Sale on a smartphone or any device that works as a register. It helps you take debit or credit card payments and contactless payments on the go.

One of the most important advantages of mobile POS devices is that they provide a smoother shopping experience. Customers don’t have to wait in long queues and can use their time browsing products and making purchase decisions. Mobile POS devices also enable retailers to track inventory, manage stock, and provide faster customer service.

How to choose the right mPOS for your business?

When looking for the best mobile point-of-sale provider for your business, consider the following factors:

- Security: A secure mPOS is PCI compliant and lets you take all the encrypted payments like NFC payments and chip cards.

- Simplicity: Look for one that has a simple interface and is easy to use. Consider the one that comes with an intuitive interface so that the employees get trained quickly.

- Affordability: It is very important for the mobile POS to be affordable, so make sure what you are spending. Apart from the hardware cost and the credit card transaction fee, there could be other fees which you must be aware of.

Related Read: All About EMV Chip Card

3. Contactless payments:

Contactless payments are all the rage nowadays. Introduced in 2006 with MasterCard’s PayPass and Visa’s payWave services, they are one of the most accessible and easiest ways to pay anywhere. Businesses can benefit from the technology by saving on transaction fees and faster checkout.

This contactless technology also makes headway in other areas of our lives, like public transportation and the workplace. For instance, contactless cards make getting onto buses and trains easier. Some industries let their employees pay for lunch with a simple swipe of their card rather than fumbling with cash or pulling out a credit card. It uses RFID to make in-store transactions more convenient, safe, and fast.

4. ACH transactions:

ACH transfer is an electronic funds transfer using the Automated Clearing House (ACH) network.

The ACH system includes participants from both the financial and payment industries. Banks, credit unions, thrifts, and other depository institutions are the account originators. They are the ones who initiates ACH transactions by submitting debit or credit entries to the Federal Reserve’s ACH operator.

Letters of Credit are used for international transactions because they depend on a common set of rules that all parties involved in international trade can understand.

How do ACH payments work?

ACH is often processed in two ways: credit and debit. While the debit process includes the withdrawal of funds from the bank, the credit is used by employees to deposit the payroll directly into the bank.

In both the credit and debit payments, the originator enters the ACH transaction into the payment system. The originator is responsible for doing the required authentication for every transaction.

Advantages of ACH transactions:

Using ACH transactions to pay bills comes with various advantages.

- Save money with bills: Paying bills or recurring monthly expenses through electronic ACH payments helps save you more in monthly bills.

- Quickly send and receive payments: Transferring funds or settling transactions from one bank to another through the ACH network is easier and less time-consuming than wired transactions.

- Low transaction fee: Another benefit of ACH is low transaction fees, depending upon your bank and the type of funds involved. Compared to wire transfers, they are more cost-efficient and are known for their speed.

- Recurring and flexible billing: This will help create a reliable flow of revenue in your business as you can set the ACH payments once or schedule them for future dates.

Related Read: How Payment Processing Can Help Grow Your Small Businesses

5. Authorization rate optimization:

This technology allows retailers to increase their revenue from online transactions using machine learning and data. It is primarily designed for businesses that need to access a high volume of digital payments.

Having a high authorization rate with zero declines will add extra revenue to your business. There are several things you can do to increase your authorization rate. Some of them are:

- Optimize the payment flow: The optimal payment helps balance the conversion rate, customer experience, and cost, which will differ for every business.

- Collect and submit the additional billing information: If you are entering the charge request, include as much information as possible. This will give the bank more details about legitimate transactions.

- Keep your fraud rates to a minimum: Businesses with high chargeback rates often see more declines. So, try to keep your fraud rate to a minimum to increase your ARO.

Enable card account updater: Update your card account updater to reduce customer declines and optimize the authorization rate.

**Related Read: Top 9 Challenges in Online Payments and How to Overcome Them**

6. Identity authentication:

Traditional methods of authentication (e.g., KBA, SMS-based 2FA) don’t provide much identity assurance. Thanks to large-scale data breaches and identity theft, businesses can’t trust that someone is who they claim to be, even if they have their mailing address or possess the correct Social Security number.

However, physical and behavioral biometrics can be applied as authentication methods for card-not-present (CNP) transactions and provide the strong layer of defense needed to protect against mobile fraud. When both biometric technologies work together, it makes it even more difficult for fraudsters to mimic customers.

7. Face-Based authentication:

Given our collective obsession with our smartphones, it’s not surprising that face-based biometrics are becoming the most popular method of authentication thanks in large part to Apple’s Face ID.

It is convenient and much more secure than traditional methods of online verification. Also, it cannot be hacked or duplicated. It’s a simple one-step solution to the problem of remembering a vast array of PIN codes and passwords.

8. 3D secure 2.0:

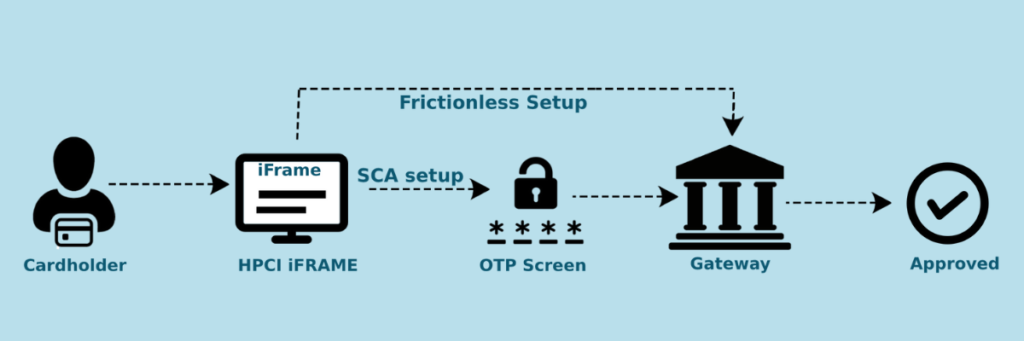

3D Secure (3DS) is a globally accepted authentication solution designed to make eCommerce transactions more secure in real time by providing an additional layer of security. It enables the exchange of data between the merchant, card issuer, and, when necessary, the consumer to validate if the transaction is being initiated by the rightful owner of the account.

The improvement in 3DS acceptance is great news for merchants. Developed and owned by EMV, 3D Secure 2 (3DS2) is designed to improve the 3D Secure 1 (3DS1) by addressing the old protocol’s pain points and delivering a smoother user experience.

With 3DS2’s frictionless flow, cardholders can authenticate themselves without being challenged. According to Visa, the quick and painless checkout process will benefit cardholders, while merchants can expect up to 66% less cart abandonment rates.

Why should businesses care about 3D security:

- Reduced risk of fraud:

A significant selling point for 3DS is that it reduces the risk of fraud. This extra layer of security helps merchants accept card payments only from legitimate customers. Even if the customer’s card number and card details are used fraudulently, it is less likely that a fraudster would also have access to the cardholder’s 3DS pin or one-time password (OTP).

- Chargeback liability shift:

The biggest benefit of 3D Secure is the chargeback liability shift. It shifts the liability for chargebacks due to fraud from the merchant to the cardholder’s bank. This additional protection is why customers often face the 3D Secure challenge during high-value transactions such as airline tickets.

Implementing 3D Secure is the best method to comply with SCA (Strong Consumer Authentication).

9. Cross-border transactions:

Expanding your business to accept cross-border transactions is a relatively simple process. Though every expansion plan is unique, a few steps must be followed in each market, covering both technical and non-technical aspects.

Connecting to an international payment gateway is the single biggest integration lift when preparing to accept international payments. Payment gateways connect multiple payment methods and systems to make transactions safe, fast, and easy for your customers.

Selecting a payment partner is among the most important steps in any international expansion strategy. Merchants need a reliable, experienced global partner to support their expansion strategy with the widest coverage and the least incremental integration.

Beyond ease of integration, it’s important for merchants with international expansion plans to work with an acquirer with truly global capabilities.

Payment partners should not just be able to provide access to the world’s largest markets – that’s a baseline. Your payment partners should be experienced in providing payments through diverse mechanisms: local entities, cross-border payments, and other partnerships.

10. Peer-to-Peer transactions:

A P2P payment app will:

- Enable payment to a landlord or merchant on an installment plan.

- Make payment for taxi or cab services along with applied discounts.

- Set the balances when money is borrowed from a friend or a relative.

- Set a borrowing limit for anyone to withdraw some amount at a specific time or predefined intervals.

- Transfer money on any borrowing request from the people you know (typically from within your contact list)

- Split the bill amongst multiple people, especially for expenses like dinner, outings, trip payments, etc.

- Transfer money to your loved ones instantly.

- Make payments for utility bills, services, etc.

P2P has enabled people to take far greater control over their financial lives and brings a sense of relief for people when handling day-to-day expenses. The ability to quickly and securely transfer money without going through unnecessary, complicated procedures has cemented its place in the lives of modern consumers.

Even late adopters recognize the incredible convenience, speed, and simplicity that mobile P2P services offer and are becoming more comfortable using their smartphones to handle their financial needs securely.

11. Application performance management (APM):

APM refers to Application Performance Management or Application Performance Monitoring and is an essential tool to help optimize and monitor the performance of your apps.

APM, or Application Performance Management, is largely an industry or vendor-created term for anything that has to do with managing or monitoring the performance of your code, application dependencies, transaction times, and overall user experiences.

Since APM is sort of a ubiquitous term for anything and everything performance-related, some vendors use the term to mean totally different things. APM can span several different types of vendor solutions.

- App metrics-based – Several tools use various server and app metrics and call it APM. At best, they can tell you how many requests your app gets and potentially which URLs might be slow. Since they don’t do code-level profiling, they can’t tell you why.

- Code-level performance – Stackify Retrace, New Relic, AppDynamics, and Dynatrace are the typical type of APM products you think of based on code profiling and transaction tracing.

- Network-based – Extrahop uses the term APM regarding its ability to measure application performance based on network traffic. A whole product category called NPM focuses on these types of solutions.

12. Open banking:

Open banking is a system that provides third-party access to financial data through the use of application programming interfaces (APIs). It allows banks to share various data with regulated third-party service providers, such as consumer banking, transaction data, and other financial information. Customers must grant consent for sharing their data, usually by checking a box or signing terms of service. Open banking is a driving force of innovation in the banking industry, allowing new players to access the same data as big banks and create more affordable alternatives to traditional services. It also helps financial institutions understand a customer’s financial situation to recommend appropriate services. Open banking benefits consumers by enabling them to access, manage and interact with their finances on the go from the palm of their hands.

Final words:

The power dynamics of the payments industry are evolving as businesses and clients shift from hard cash and checks to digital payments. Cards are boosting retail businesses, and trends like mobile wallets paving the way for the future of payments. So, if you want to take your business to new heights, you must look into the above-mentioned trends.