Online payment security is about safeguarding your business. Being vigilant about protecting personal information and customers against fraud attacks on the internet has become important and crucial for businesses.

This is even more important with more people switching to eCommerce for shopping.

Many merchants don’t understand exactly how online payments work, but it’s important to know there are many players in the process. In addition to you, the merchant, other parties involved include issuing banks, card brands, acquirers, and payment companies.

When customers trust eCommerce businesses with their money and information, it’s their responsibility to keep that trust and ensure a secure purchasing experience.

Table of Contents

7 Things to Consider for Payment Processing Security

- SSL for Secure Connections

- PCI Compliance Certificate

- AVS (Address Verification Service)

- Tokenization

- 3D Secure Authentication

- Anti-Fraud Tools

- Up-to-Date Operating System

Read below to find out how these 7 things will ensure secure payment processing on your website:

SSL for Secure Connections

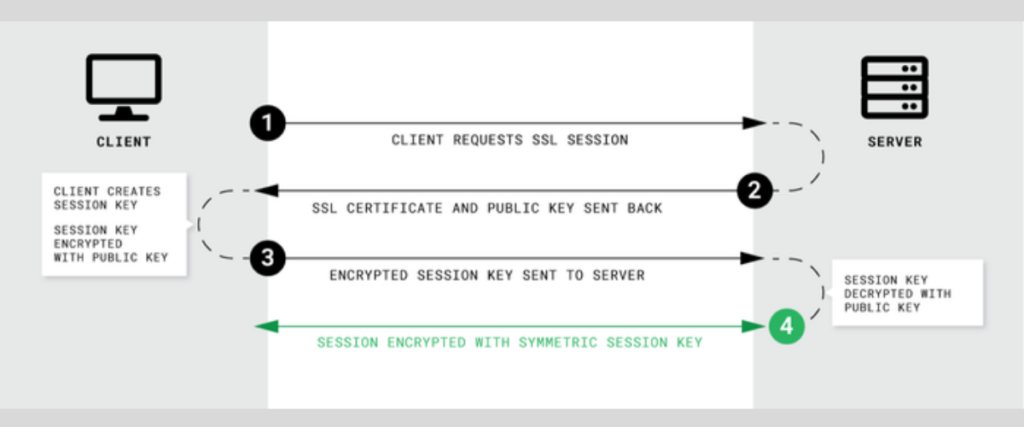

An SSL certificate is a digital certificate that authenticates a website and enables an encrypted connection. SSL, Secure Sockets Layer, is a security protocol that creates an encrypted link/connection between the browser and server.

SSL certificates ensure the security of online transactions and the privacy of client information. So, it has been protected if you see a padlock icon next to your website’s URL.

How Does SSL Work?

SSL ensures that the data transmitted between the user and the website is secure and cannot be read by anyone else. SSL uses an encryption algorithm that encrypts data during transit, preventing fraudulent activity.

The data includes sensitive information like name, address, credit card number, or any other financial information.

Here’s the complete process:

- A browser connects to the website, which is secured with SSL.

- The browser requests the webserver to confirm if the connection is encrypted.

- The web server then sends a copy of its SSL certificate to the browser.

- The browser verifies whether the SSL certificate is trusted.

- The web server then returns the digitally signed acknowledgement to start the encryption session.

- Encrypted data is then shared between the browser and the server.

PCI Compliance Certificate

PCI compliance is a set of requirements that are intended to ensure that all companies that store, transmit, or process credit card information maintain a secure environment. The PCI security standards include specification frameworks, tools, measurements, and materials to help organizations ensure cardholder information security.

PCI Compliance Consists of 4 Levels:

- Level 1: This applies to merchants who process more than six million card transactions annually.

- Level 2: This applies to merchants who process between one and six million card transactions annually.

- Level 3: This applies to merchants who process 20,000 to one million card transactions annually.

- Level 4: This applies to merchants processing less than 20,000 card transactions annually.

Why is PCI Important for Your Business Growth?

The major benefits of PCI compliance are:

- PCI improves business reputation with payment brands.

- Compliance means that your system is secure and the customers can trust you with their personal information.

- PCI prevents data breaches and payment card fraud.

- PCI serves as a globally accepted standard.

- Compliance contributes to the corporate security strategy.

- PCI improves the efficiency of IT infrastructure.

AVS (Address Verification Service) Verification:

The credit card processor and issuing bank use an address verification service to detect any suspicious transactions and prevent fraud. The AVS primarily intends to verify the buyer’s information is correct by utilizing the owner’s street name or zip code.

How does AVS work?

Despite entering the correct billing address, there is the possibility that your transaction will still be declined. This is where AVS can help.

When used effectively, AVS helps in minimizing chargebacks. By using it, you can confirm whether the billing address entered by the customer matches the one in the cardholder’s account.

At the time of checkout, customers enter their address, which is then compared to the address on the issuing bank file. Payment gateways can use the AVS code in real-time to identify how to proceed with the transaction and whether it should be approved or declined.

Tokenization:

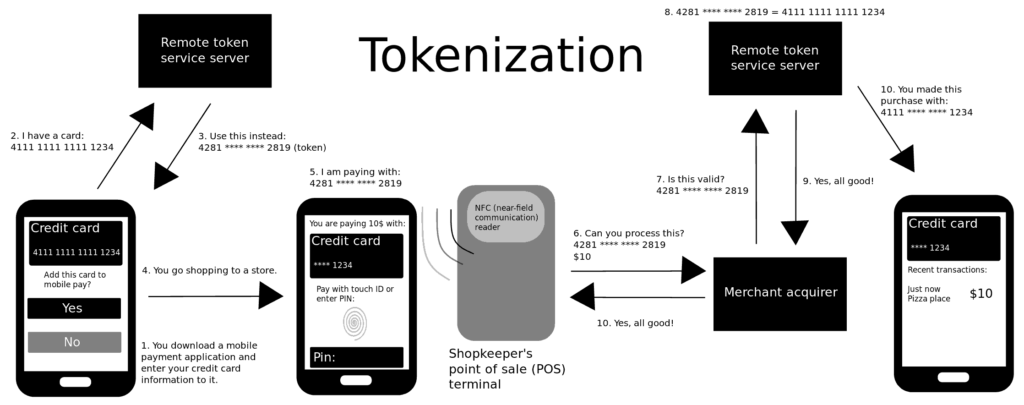

Tokenization replaces sensitive information with tokens that contain random strings of various characters. During the payment process, tokens represent the cardholder’s information, such as a 16-digit card number, or other sensitive bank account details.

This method is used because the Payment Card Industry Data Security Standards (PCI DSS) promote the adoption of payment tokenization. Since it provides merchants with a one-to-one replacement for PANs (Primary Account Numbers), it can be stored outside the PCI DSS environment. As a result, the merchant’s server does not store any sensitive information.

How Does Tokenization Work?

Tokens are automatically generated in real-time during the payment so that it doesn’t slow the process. The merchant stores customer data securely so the tokens can be used to charge subsequent purchases. With tokens, merchants cannot store or see credit card numbers, protecting customers and merchants from fraudulent activity.

In a nutshell, the process is as follows:

- The customer enters credit card details in the payment form.

- A token is created in the payment gateway API.

- The token is sent back to the merchant server.

- The merchant then securely processes the payment with the token representing the cardholder’s data.

3D Secure Authentication:

3D Secure authentication is an added layer of protection that requires customers to complete an extra verification step with their card issuers during the payment process. A 3D transaction will allow the cardholder to confirm a transaction before it is carried out.

If the cardholder uses a Visa or MasterCard to make the purchase, a code or verification notification will be sent to ensure the cardholder’s authenticity.

How Does 3D Authentication Work?

- At checkout, customers need to enter their card information.

- Assume that you, the merchant, have 3D authentication enabled. The customers will be asked to verify their identity through a pop-up window.

- Next, the bank will send a secret authentication code to the registered mobile number.

- Customers need to enter this one-time applicable code to make a payment.

- After the code is verified, the payment is accepted, and the purchase is completed.

Anti-Fraud Tools:

The most common type of credit card fraud occurs when the card is stolen or lost or when the cardholder’s personal information is used to make unauthorized transactions. These frauds may lead to consequences like the loss of revenue and resources, chargeback fees, or the possible termination of the account. Therefore, an anti-fraud tool is crucial to ensure secure transactions.

What role will anti-fraud tools play?

- Real-time help to stop criminal fraud

- Prevent unnecessary bank proceedings

- Dispute chargebacks

Related Read: Challenges in Online Payment Processing (& How to Fix Them)

Up-to-Date Operating System:

Keeping your operating system updated is an essential personal identity security practice. Outdated technology is vulnerable to increased risks and financial losses. Outdated technology may also lead to data breaches, eroding customer trust and affecting your credibility.

To ensure security, the operating system must be updated with the latest patches as soon as they are released.

How does an up-to-date operating system help?

- Safer transactions

- Increased customer trust

- Encrypted data with no data breaches

Wrapping Up

Finally, when choosing a payment processor for your website, make sure it includes:

- Data encryption

- PCI compliance certificate

- SSL for secure connection

- 3D Secure

- Anti-fraud tools

- AVS protection

Secure online transactions and payments are essential to prevent fraudulent payments and data breaches. Without fraud prevention, the best-case scenario is that chargeback fees can eat into your profits, and in the worst case, a breach of your customer cardholder data can end your business.

Advanced payment processing solutions, like GETTRX Zero, enable businesses to protect customer data and protect against such breaches. GETTRX takes all necessary security measures to protect its customers’ data.

For more information on Payment Processing, check out these resources: Payment Processing Basics, The Importance of Payment Processing, Payment Processor vs ISO.